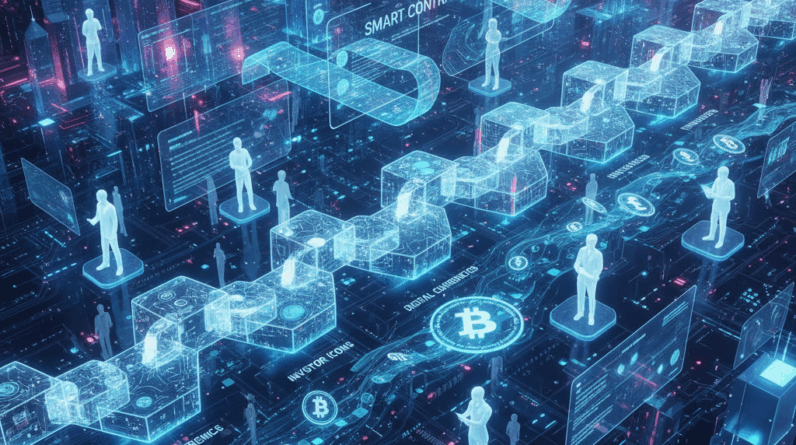

Decentralized Finance, commonly known as DeFi, has transformed from a niche crypto experiment into a rapidly expanding ecosystem reshaping global finance. Unlike traditional banking, DeFi provides financial products and services through blockchain-powered smart contracts without intermediaries. In 2025, DeFi continues to unlock unprecedented opportunities—while also presenting serious risks that investors must understand before participating.

What Is DeFi?

DeFi platforms use public blockchains like Ethereum to run financial applications that don’t rely on banks or brokers. Users interact with smart contracts to lend, borrow, trade, and earn interest on crypto assets directly from their wallets. This permissionless system promotes full control and transparency but requires users to assume all responsibility for their funds.

Opportunities in DeFi

-

Financial Inclusion: DeFi offers banking services to millions worldwide with no credit check or geographic restrictions, making finance accessible to the unbanked.

-

Yield Farming and Staking: Investors can earn high returns by providing liquidity or staking tokens in various protocols.

-

Programmability and Innovation: DeFi enables sophisticated derivatives, decentralized exchanges, and cross-chain interoperability that traditional finance struggles to match.

-

Lower Fees and Faster Transactions: Layer-2 scaling solutions have reduced transaction costs and increased speed, making DeFi more practical for everyday use.

-

Integration with Real-World Assets: Increasing tokenization of real estate, stocks, and bonds brings traditional value into decentralized ecosystems.

Risks and Challenges

-

Security Vulnerabilities: Despite audits, smart contracts are prone to bugs and hacks. In 2023, DeFi platforms lost over $735 million due to exploits.

-

Regulatory Uncertainty: Lack of clear regulations across jurisdictions raises risks for investors and platforms, creating a “grey area” full of potential legal challenges.

-

Volatility: Cryptocurrencies and tokens powering DeFi are highly volatile, exposing investors to substantial financial risk.

-

User Responsibility: Unlike banks, DeFi users manage private keys and wallet security. Loss or theft of keys means permanent loss of funds.

-

Low User Retention: Many users experiment but do not stay engaged long-term, impacting liquidity and platform sustainability.

How to Safely Invest in DeFi

Investors interested in DeFi should prioritize security by using trusted wallets, understanding smart contract risks, and diversifying investments. Research projects thoroughly and be wary of platforms promising unrealistic returns. Staying updated on regulatory developments is also critical as increasing oversight approaches.

The Future of DeFi in 2025 and Beyond

DeFi is poised to become a foundational layer in global finance with innovations like AI-powered risk management, legal recognition of decentralized autonomous organizations (DAOs), and growing institutional interest. As technology matures, regulatory frameworks develop, and real-world asset integration grows, DeFi’s potential for disruption and financial inclusion will only expand.